What are reporting standards?

With global commitment towards sustainable development, governing authorities and investors are increasingly aware of corporate ESG practices. To ensure clear, transparent, and comparable information surrounding corporate ESG practice, trusted regulatory bodies (such as the TCFD) have provided metrics and frameworks for standardized sustainability reporting.

What is TCFD?

‘TCFD,’ referring to the ‘Task Force on Climate-Related Financial Disclosure,’ is an international regulatory authority that is committed towards evaluating financial risk in the face of climate transition. TCFD Disclosure guidelines allow firms to demonstrate climate change resilience to capital providers.

Why do firms disclose?

In some regions, sustainability disclosure according to TCFD standards is necessary to meet regulations imposed by regulatory authorities, (such as HKEX or SGX). However, even without mandatory disclosure regulations, many firms choose to report in order to comply with investor disclosure requirements, attracting green finance opportunities, improve brand image, and instill consumer confidence.

Who reports against TCFD?

.png/th1000)

Four Pillars of TCFD

What are Scope 1, Scope 2, Scope 3 Emissions?

Quantitative measurements & estimates required

Greenhouse gas (GHG) emissions are sorted into three types depending on their source. Scope 1 and Scope 2 emission data has become increasingly accessible as they are common requirements of other reporting frameworks. However, it is still often difficult to find data on Scope 3 emissions.

Scope 1

Direct emissions from owned or controlled sources

For example: company vehicles, company facilities

Scope 2

Indirect emissions emissions from the generation of purchasing electricity, steam, heating and cooling

Scope 3

All other indirect emissions within a company’s value chain

For example:

Upstream activities – Capital goods, transportation, business travel, employee commute

Downstream activities – Investment, franchise, use of sold products

How does TCFD Compare?

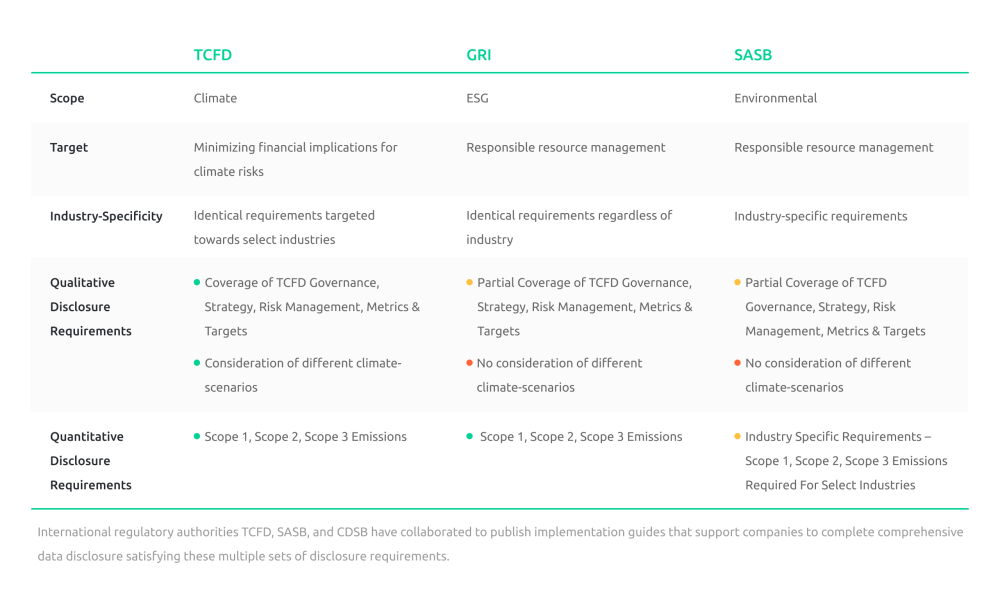

Examine the key differences between TCFD and the world’s most commonly used sustainability reporting standards – Global Reporting Initiative (GRI) standards, and Sustainability Accounting Standards Boards (SASB)

International regulatory authorities TCFD, SASB, and CDSB have collaborated to publish implementation guides that support companies to complete comprehensive data disclosure satisfying these multiple sets of disclosure requirements.

Where Do I Begin?

- Essential Tips for Success

- Form the perfect working group

A multidisciplinary team from different departments to ensure comprehensive coverage of business operations. Ensure that the board of directors and executive leadership team are involved in the disclosure process.

- Set Appropriate Scenarios

Determine climate scenarios for different time frames and warming scenarios. How do they differ from each other? Identify relevant climate risks and opportunities. This may be an unfamiliar process for many firms as most other disclosure frameworks do not mandate evaluation under different climate scenarios.

- Comprehensive Risk Assessment

Identify both physical and transitional risks: Physical risks refer to areas where climate change can impact your business, while transitional risks are risks arising from transitioning to low-carbon business operations. Look specifically at how these risks can impact company revenue, expenditure, assets, liabilities, and financial capital

- Ensure quality through internal and external assurance

Companies can seek internal or external assurance to ensure quality and accuracy of data disclosed